Bogus self-employment has always been rife in construction. But a combination of factors are fuelling its growth in other areas – from transport to care to security services. Even seemingly innocuous sectors like teaching and local government appear to be at risk.

How many people are falsely self-employed?

Up until recently this question didn’t elicit much interest, at least beyond a handful of academics and civil servants in HMRC. But then came the fallout from the bankruptcy of the City Link delivery firm. Of its 4,000 drivers, it turns out a quarter were on self-employed contracts. By all accounts these workers were employees of the company; they wore City Link uniforms, drove City Link vans and did essentially what City Link told them. The tragedy is that, not being on payroll, they received no redundancy pay when the company went bust.

The only silver lining to this incident is that it has helped to prompt a valuable debate about the prevalence of bogus self-employment across the economy. Of course, this phenomenon has always existed, not least within construction. The union UCATT believes that as many as 50 per cent of all construction workers are falsely self-employed, a figure that dipped in the mid 2000s as a result of government action but rose shortly afterwards as unscrupulous employers found new loopholes.

Yet there are indications that bogus self-employment may be spreading to other sectors. Anecdotal evidence from online forums, for example, suggests an increasing number of teaching staff are being encouraged by their employers to register as self-employed. A panorama investigation found the same behaviour in the hairdressing industry. Even sectors characterised by strict safeguards are at risk. The EU Commission, for instance, is concerned that pilots in the airline industry are being turned away from prospective employers if they do not agree to sign a contract stipulating they are self-employed.

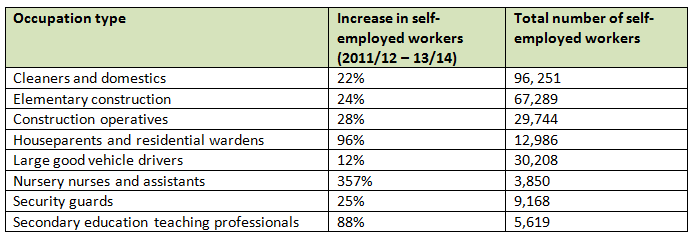

While it is difficult to determine the true extent of bogus self-employment, simple crunching of labour market data suggests there is indeed cause for concern. The box below shows that, according to the Labour Force Survey, there has been a significant increase in the number of people who work for themselves in occupations that we would typically associate with conventional employee-employer relationships. Among nursery assistants there has been a 357 per cent increase in self-employment between 2011/12 – 13/14, while among secondary education teaching professionals the figure is 88 per cent.

Needless to say, many of these will be genuinely self-employed, but it is difficult to see how all these arrangements could be authentic given the nature of the work.

But what’s the big deal? Hasn’t the RSA extolled the virtues of self-employment and championed the recent boom? This much is true, but we are only interested in backing meaningful self-employment that allows people to flourish as creative individuals. The problem with the bogus kind is that most of those affected suffer all the downsides of working for themselves but few, if any, of the benefits. They are still an employee in the sense of having to follow someone else’s orders and agree to a predetermined hourly rate. Yet they forgo all the benefits typical employees take for granted, including redundancy pay, holiday pay, sick pay and maternity/paternity pay – to name but a few.

Not that the costs of bogus self-employment are limited to workers. The state for one misses out on millions in unpaid tax receipts, since the falsely self-employed pay lower employee NICs and the companies involved pay no employer NICs whatsoever (this is the main advantage to firms cheating the system). UCATT thinks this activity in the construction industry costs the Treasury around £2 billion a year. Worse, these firms gain an unfair advantage over their competitors who do play by the rules, in turn encouraging the latter to join them in surreptitious behaviour. The end result is a race to the bottom, with knock-on consequences for training, skill levels and overall productivity.

The concern is that bogus self-employment is only likely to become more commonplace. One reason is because of the introduction of pension auto-enrolment. This could prompt many firms (particularly small ones) to nudge their workers into self-employment so as to avoid making obligatory pension contributions. Another factor is the continued squeeze on public sector budgets, which may encourage local authorities, schools, hospitals and other public institutions to toy with self-employment arrangements in a bid to cut costs. What are now rare working arrangements may soon become commonplace in the next 5 to 10 years.

To be sure, the government has made noteworthy progress in addressing bogus self-employment. The Chancellor highlighted the problem in his 2013 Autumn Statement, and in the following year HMRC introduced new legislation to limit the ability of ‘onshore intermediaries’ (payroll companies and employment agencies) to present employees as self-employed. Yet critics, not least the unions, believe these efforts have not gone far enough. Indeed, we have already seen payroll companies sidestep the new regulation by creating umbrella companies that use complex tax arrangements to pass on employers’ costs to workers.

So what is to be done? The honest answer is that I don’t know, and nor do most organisations in this space. What I do know, however, is that we need to begin talking about it. As mentioned at the outset, it is only recently that bogus self-employment has even been recognised as an issue, at least beyond the construction industry. This is partly because of a misplaced belief among some that any mention of it may demean the overall image of self-employment, just as there is an ill-advised tendency to avoid discussing (and addressing) the general hazards of self-employment in case it puts people off starting up in business.

Self-employment is growing and that is a good thing. But there is only so long we can ignore the darker side of this phenomenon.

Follow me on Twitter

Related articles

-

The self-employed: rich, poor or something more?

Benedict Dellot

Barely a week goes by without another news story charting the fall of self-employed earnings. But how much do the headlines match reality?

-

5 tax reforms to create a more entrepreneurial society

Benedict Dellot

Small businesses don't want sweeping tax cuts and special favours. They want a tax system that is clear, fair and progressive. Here are 5 ideas to get us started.

-

Blog: A Budget of boons for the self-employed

Benedict Dellot

Hidden away in the Budget Red Book were several announcements to satisfy the self-employed

Join the discussion

Comments

Please login to post a comment or reply

Don't have an account? Click here to register.

It is a frightening existence on the margins of society. I'm a fully fledged employee of the RSA. But have freelanced in the past.

I am probably one of the last self-employed in the western world. It is a frightening existence on the margins of society. Governments and authorities increasingly seem to think 'self-employed' means 'crack dealer' or 'terrorist'.

Alas, no. I'm a fully fledged employee of the RSA. But have freelanced in the past.

Hi Benedict thanks for the interesting blog. Just one question are you self-employed?