Money definitely talks. It takes a while to understand what it’s saying sometimes, but today it spoke and loud and clear.

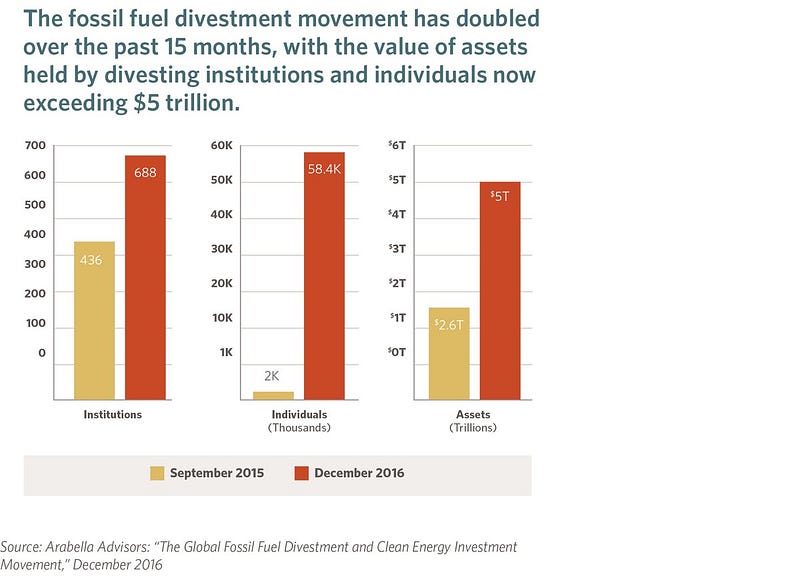

At a simultaneous press conference in London and New York, the DivestInvest movement, a coalition of NGOs, financiers, universities and faith-based organisations, launched a report announcing that 5.2 Trillion US Dollars have been ‘pledged’- this amount has doubled in just over a year. In investment terms that’s a resolute signal, and it in essence that means a huge amount of money that would have gone to coal, gas and oil will now go to renewable energy.

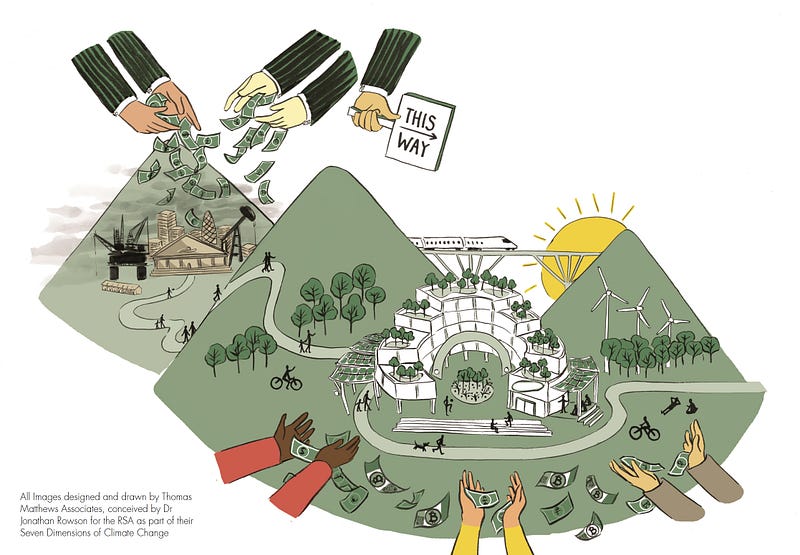

What that ‘says’ is that there has been a perceptible shift in the direction and momentum of how the world will power itself. In terms of energy ratios, fossil fuels are still huge, but they are wounded in various ways and getting smaller. Renewables may still be small, but they are increasingly emboldened and getting bigger (for details see Carbon Tracker). And now it’s mostly about the speed and scale of the necessary energy transition and the role of money in directing that. I published a report at the RSA at the end of 2015 on this subject called ‘Money Talks’ but the core message is captured by one of the world’s leading climate change diplomats, Christiana Figueres:

“Please keep this simple equation in mind: Quality of investment today, equals quality of the global energy system tomorrow, equals quality of life forever.”

The Seven Dimensions of Climate Change: Money.

Climate change is about much more than money, but the divestment and investment data is tangible in a way that government targets simply can’t be. As Trump’s election shows, politics has a way of getting in the way of pledges, so today’s announcement is a reassuring follow up to the celebrated Paris COP 21 agreement, which happened a year ago. To put it crassly, people are “putting their money where there mouths are”.

There are some questions that come to mind (5.2 versus what? How much is invested in fossil fuels? What is the total value of the global economy?) but I want to focus on a deeper point that is not captured in today’s data or press release.

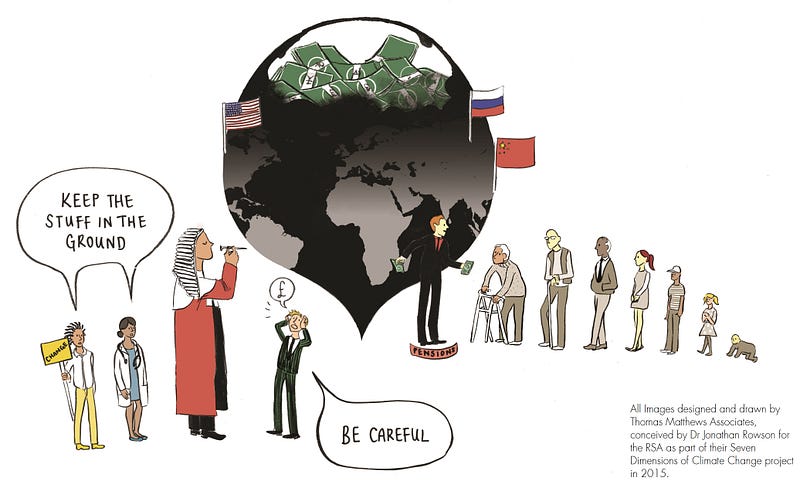

For most people, climate change and money do not ‘belong together’. At first blush they seem to be very different things. When I first came across the idea that pension funds might be the place to look for hope on climate change my mind was completely blown. To the uninitiated, climate change is about ‘the environment’ and green stuff more generally, with perhaps a few polar bears thrown in. Money is the crisp or jangly thing in your wallet, the serious stuff that everybody wants more of. In this respect today’s announcement is also about raising political consciousness. DivestInvest has a collateral purpose in helping people think systemically about a challenge that has to be understood and tackled at the level of the whole system.

The following anecdote gives that thought some definition. When Barack Obama made his first ‘big speech’ on climate change in June 2013 I was just getting to grips with climate change and I wrote a slightly gushing blog post saying how much I liked the speech. A few hours later I was struck by a response comment by Warren Hatter: “If the markets aren’t spooked, then he hasn’t said anything that significant.”

In other words, if money is not talking in response to what the President is saying, then maybe he hasn’t said so much after all? There is a fine line between cynicism and realism here, and we have to be mindful of economic imperialism (it’s *not* all about money) but I think the point is broadly correct. Over the rest of 2013 I wrote A New Agenda on Climate Change and came to understand the complexity of the global energy system and the role of capital in maintaining its shape and size. Two years later I developed this idea with another RSA report called Money Talks: Divest Invest and the battle for climate realism.

It’s perhaps worth sharing that although I strongly support divestment in fossil fuels and reinvestment in renewable energy, I am not a particularly financially minded person, and nor do I consider myself particularly combative. My interest in climate change is more about a fascination for complex systems and the psychological features of human denial.

But just look at how it all fits together; how human needs and aspirations are manufactured through advertising, how consumption-based economic growth remains governments’ overriding objective, how energy demand is rising indefinitely in the developing world, how we continue to subsidise fossil fuels…and therefore how hard it is to believe we could really rapidly cut or eliminate emissions…

When you look at the scientific case to get to net zero emissions quickly to minimise climate risk it’s hard to avoid the conclusion that we have to focus, fast. In particular we have to do all we can to keep fossil fuels in the ground, and we have to accelerate that process without crashing the economy, and keeping some suitably nuanced sense of ‘fairness’ in mind. So much of the global economy is premised on the value of fossil fuel stocks that cannot be used. What follows is that the ‘carbon bubble’ has to deflated, but wisely and judiciously, as the following illustration suggests:

Seven Dimensions of Climate Change: Law

This idea that you should ‘follow the money’ reflects a wider point about the difference between ‘the signal’ and ‘the noise’, a distinction made famous by the Pollster Nate Silver’s book by that title. There is a lot of noise on climate change, not least what Donald Trump thinks about it at the moment, just how bad it is, whether the Pope’s Encyclical made any difference, whether the Arctic is really as 20 degrees celsius hotter than normal at the moment, and so it goes on…

It’s all noise. Fascinating, and not irrelevant by any means, but we need a signal. Today we had one. There are 5.2 trillion new reasons to be hopeful.

@Jonathan_Rowson is the founding director of Perspectiva, and former Director of the Social Brain Centre at the RSA.

He is currently writing a book for Palgrave Macmillan called The Seven Dimensions of Climate Change: rethinking the world’s toughest problem. He is a chess Grandmaster, Trustee at Climate Outreach and an RSA Associate.

Be the first to write a comment

Comments

Please login to post a comment or reply

Don't have an account? Click here to register.