Pension coverage for the self-employed is pitiful, with just a fifth signed up to a private scheme. Could nudging be part of the answer? And what about ISAs? Here we take a look at how the self-employed might be helped to prepare for a more secure retirement.

The forgotten 4.8 million self-starters

Last week the government officially launched its review into pension auto-enrolment, the programme through which employees are signed up to a private pension scheme by their employer.

Measured against its central goal of boosting enrolment, the scheme has been a huge success. According to our own analysis, the proportion of employees paying into a private pension has grown from 50 percent in 2012/13 to 61 percent in 2014/15. Nest, the state-backed pension provider, now has 4 million employees on its books.

That’s the good news.

The bad news is that one group in particular has been locked out of the auto-enrolment drive: the self-employed. That’s the best part of 4.8 million people, or 1 in 7 of the UK’s workforce.

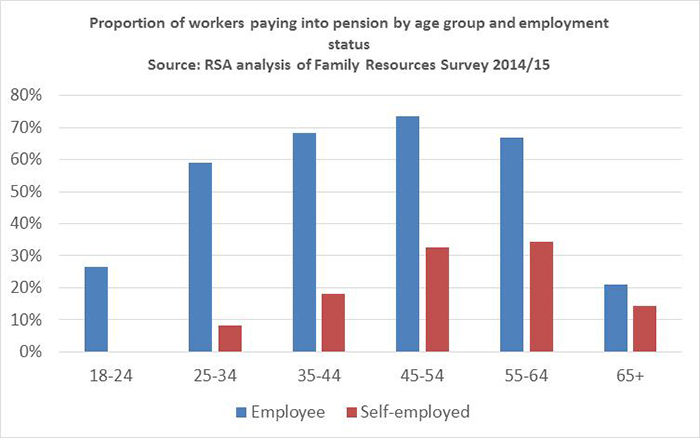

So while the proportion of employees saving into a pension has grown, the share of self-employed workers doing likewise has actually fallen – from an already low base of 26 percent in 2012/13 to 23 percent in 2014/15.

And the few self-employed people who do save also tend to stash away smaller amounts. Those closest to retirement (in the 55-64 year age bracket) have £85,500 saved on average, compared with £162,250 for employees – nearly a twofold difference.

Not only that, self-employed workers also appear to begin saving later in life, with just 8 percent of 25-34 year olds actively contributing to a private pension versus a mammoth 59 percent of employees of the same age (see graph below).

Why does this matter? Because late savers miss out on the benefits of compound interest. The Money Advice Service reckons that someone saving £100 a month for 40 years would rack up £190k upon retirement, assuming an annual average growth rate of 6 percent. But someone saving £200 over 20 years would amass a pension wealth of just £90k, despite putting away an equal amount.

From auto-enrolment to ‘forced choosing’

These are big numbers and could be the difference between eking out a living in old age and retiring with dignity and peace of mind. So at the RSA we see a clear case for using nudging techniques to boost the numbers of self-employed people saving for retirement.

In practice, the self-employed could be presented with a ‘forced choice’ question when they complete their tax self-assessment form with HMRC. This would mean asking them – yes or no – whether they would like to save into a private pension programme, and whether pension providers could contact them about their products.

Earlier this year, the Julie Deane Review into self-employment cast doubt on the idea of nudging people in this way. But Deane’s report referred only to ‘auto enrolment’, overlooking the fact that there are many variants of nudging that can be deployed, including the forced choice approach.

One study undertaken by Harvard researchers in the US found that presenting workers with a compulsory pensions question led to enrolment rates increasing from 9 percent to 34 percent in the first four months of job tenure – proving that there is an effective alternative between no action and full auto-enrolment.

Making the most of the new LISA

Yet pensions are not the only means of saving for retirement. We also have to look at how the self-employed use ISAs, which can be more appealing given the greater ease with which people can get hold of their savings.

Indeed, business owners who lack access to sick pay, or who need a safety cushion in case of a rocky period, are understandably more drawn to flexible ISAs than pensions which lock away their money until old age (even if pensions do offer better returns).

In this regard, the government’s new Lifetime ISA (LISA) could prove to be the ideal savings vehicle for the self-employed. Under the scheme, the government gives savers £1,000 for every £4,000 deposited – and people are technically able to access their cash at any time.

However, the LISA is beset with a number of design flaws, a major one being that accounts cannot be opened by anyone over the age of 40. Given that many of the older self-employed still lack access to adequate savings products, there is a clear case for raising the age restriction, possibly by another 10 years.

Another shortcoming of the LISA is that people who withdraw money before they reach retirement, or for any other purpose than buying a house, face a stiff penalty and lose their bonus. We think the penalty should be scrapped entirely, and that the government should consider enabling people to withdraw small amounts from their LISA while keeping their bonus, on condition the money is repaid within a short period.

The government might also consider allowing savers to take out loans against their LISA or pension products, which is a key feature of the US 401(k) pensions system.

The above ideas are by no means perfect. The devil is always in the detail and we should not kid ourselves that there is a silver bullet here. But the point is that the government does have the scope to make a real difference, and it certainly shouldn’t be held back by an archaic notion that the self-employed want to be left to fend for themselves free of state intrusion.

When it comes to New Year’s resolutions, a commitment to boosting retirement protection for the self-employed should be a no brainer for the government.

The RSA is working with Crunch, the online accountants for micro businesses, on a project that seeks to deepen our understanding of what works in supporting the self-employed and micro-businesses.

Be the first to write a comment

Comments

Please login to post a comment or reply

Don't have an account? Click here to register.