The blame for the financial firestorm that engulfed the world in late 2008 has fallen on a myriad of different parties. Whilst each played their part Jay Majeethia argues that the true cause lies in the very structure of our financial system and the rise of a quiet giant.

To understand this structure, one must view money in its true form, essentially IOUs. Central banks are the initial creators; they are able to print it and loan it to commercial banks. The commercial banks then lend it out to private individuals and businesses. It flows around the system being exchanged for goods and services and eventually ends up back in the commercial banks as deposits. The banks can then lend it out again, keeping a certain portion in reserve, and the process repeats. Hence the initial money that the central bank creates is multiplied many times. With a 10% reserve ratio, the total amount of money in the system is ten times the amount that the central bank creates (at the extreme). This is the fractional reserve banking system.

The system is somewhat like a piece of elastic being wound tighter and tighter around a finger, but if there is a weak spot in the elastic, in that a borrower is unable to service their debts, the elastic snaps and the system unravels. Banks have put tools in place to minimise the unravelling risk, one of these is to evaluate a borrower’s ability to pay by looking at the value of their assets and their future earnings.

Calculating this is not easy. As an individual, you are able to calculate the value of your assets by measuring how much you could sell all your assets for in the market today. But how do you calculate what you will be earning in a decade? With all the external factors that could influence it this is just an educated guess. Now try doing this for a business, how can you tell whether the little café down the road will be the next Starbucks or whether Starbucks will be the next Enron? It’s an imprecise art that is often based on extrapolated past earnings and the fluctuating market value of a borrower’s assets.

During the last boom, banks started lending more, which fuelled consumer spending; this led to increasing business profits (pushing up stock markets) and increased wages for its workers. Furthermore, the increased lending led to higher demand for assets, particularly houses, which saw prices rise and coupled with rising financial asset prices and increasing wages made consumers feel wealthier. The money flowed back to banks, which re-lent it given the increasing earnings and wealth and the cycle repeated. Effectively the elastic wound tighter. If the West were a closed economy with only a fixed output of goods and services then all this additional money creation would have led to inflation, but in the case of the recent boom this general inflation didn’t dramatically arise.

The reason is that the excess demand was soaked up by exporting nations, particularly the great factory of the world, China. The Chinese worked diligently to produce many of the goods that the Western economies demanded, but rather than reciprocating by splurging their earnings on goods and services produced by the West they continued their culture of saving. The Chinese typically save over 40% of their income as opposed to the single digit percentages of the Western economies. Their savings ended up in Chinese banks and amounted to over $3tn by March 2011. To give you a sense of scale, China could use $1.9tn to buy all the farmland and farm buildings in the continental US, for $0.5tn they could add on the real estate of Manhattan and Washington DC and whilst they’re going they could buy all the US’ military equipment and the world’s 50 most valuable sports teams and still have change to spare.

In a global free market a safety valve should have activated, an appreciation of the exporter’s currency, which would make the cost of importing more expensive and hence stem demand. However, China’s currency was pegged and so the trading imbalance and consequently China’s balance of foreign currencies grew unhindered. With all this money being held in the Chinese system (and that of other exporting nations), less was flowing around Western economies and hence Western consumers began earning less and so spent less. Western businesses’ profits fell, stock markets followed suit and borrowers started to default on their loans. Banks exacerbated this by (quite rightly) reining in lending which caused a further fall in demand for assets, prices followed and borrowers’ ‘wealth’ began to evaporate. A rapid, self-reinforcing unwinding of the elastic began.

But the glut of money created by the West and sent abroad didn’t disappear; it’s still there, a vast pile of IOUs. A large chunk of the pile has been lent to Western governments and some has been used to finance failed banks. So via a rather convoluted process the Chinese, in particular, have sent the West a vast quantity of goods, which the West has happily bought using a loan - from China. And what does the West produce to repay the exporters? Not enough.

Therefore, any recovery must be supply-led, but the demand must come from the boom-time exporting nations and not from coaxing further Western consumption. The West should meet this demand by producing goods and services that the boom-time exporters want to consume but can’t produce. Investment and education must be targeted to this end. That is how a competitive advantage can be rebuilt. The process can be helped by China continuing its revaluation of the Yuan and eventually floating it; and of course the West can live in hope that the Chinese become a nation of spenders as opposed savers.

The UK has started along this path; the annual shortfall between exports and imports has been narrowing recently, from the additional £45bn accumulated throughout 2006 to just £15bn being accumulated in 2009, but this is due more to consumers having less to spend on imports than the UK boosting exports.

One may argue that there is little that the UK can produce that the boom-time exporting nations can’t produce more cheaply, but there are a plethora of industries for which the UK has a competitive advantage; notably complex design and manufacturing industries such as aerospace and defence, pharmaceuticals and technology, and exportable services such as (appropriately regulated) financial services and software development.

Policy must be adjusted to encourage students and the unemployed alike to train as workers to fill roles within these industries. One such policy might be to give students of particular university courses, such as engineering or chemistry, subsidies on their university fees. Furthermore, entrepreneurial firms that export, or put more generally, firms that ‘repatriate pounds sterling’, should receive incentives such as tax breaks while they grow (but should never be subsidised). Finally, success in business, particularly the exporting kind, should be celebrated and not punished, as this type of success is the only way to work the UK out of its economic quagmire.

Jay Majeethia graduated from the LSE with a degree in Economics and currently works at a global financial services firm in London.

Related articles

-

Worlds apart

Frank Gaffikin

We are at an inflexion point as a species with an increasing need for collaborative responses to the global crises we face.

-

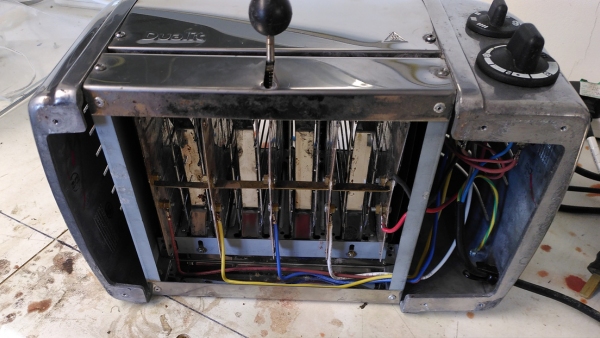

Why aren't consumer durables durable?

Moray MacPhail

A tale of two toasters demonstrates the trade-offs that need to be considered when we're thinking about the long-term costs of how and what we consume.

-

You talked, we listened

Mike Thatcher

The RSA responds to feedback on the Journal from over 2,000 Fellows who completed a recent reader survey.

Be the first to write a comment

Comments

Please login to post a comment or reply

Don't have an account? Click here to register.