This week the RSA publishes a new report looking at the economic impact of the micro business boom. Will this worsen or alleviate the UK’s lacklustre productivity performance? Will it help or hinder much needed innovation? And what will it mean for job creation and the quality of work? Here we spell out the answers to these and other questions.

Defined as firms with 0-9 employees, the number of micro businesses now stands at 5 million, up from 3.5 million in 2000. In contrast, the populations of all other sized firms have either increased only marginally or fallen in number.

The result is that micro businesses today account for 33 per cent of private sector employment and 19 per cent of total output.

The RSA has dubbed this trend ‘the second age of small’, in reference to the fact that cottage industries were once the norm in pre-industrial Britain.

2. Many see this as a bad economic omen and a sign of a fragmented labour market

Not everyone is enthusiastic about this phenomenon. A key point made by the critics is that large micro business populations are characteristic features of poor countries, not rich ones. The developmental economist Simon Kuznets long ago argued that small firms would diminish in number and be replaced by large ones as countries became more prosperous. Modern day economists harbour the same doubts. Speaking at our Self-employment Summit earlier this year, the economist Will Hutton argued that the growth in self-employment is “part of a picture of capitalism that is seriously dysfunctional”.

3. But our research finds that micro businesses may help to spur productivity

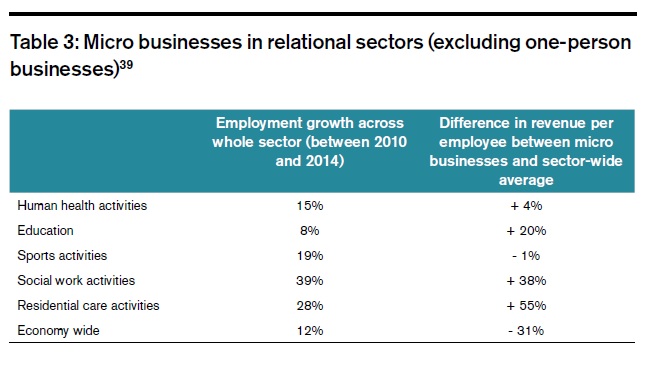

Straightforward analysis of government data shows that micro businesses are less productive than their larger competitors, with a turnover per employee that is on average half that of very large firms (500+ employees). However, this analysis does not take into account the high degree of churn within the small firm community, with half of people starting up in business never making it to their third anniversary. Were we to concentrate on long-standing firms, the overall financial health of the micro business population would look significantly better. Another caveat is that productivity among firms varies enormously by industry. When we exclude sole traders, we find that micro businesses have higher productivity levels in 9 of the 19 fastest growing sectors, particularly those based on relationships such as education, health and social work.

4. … and innovation

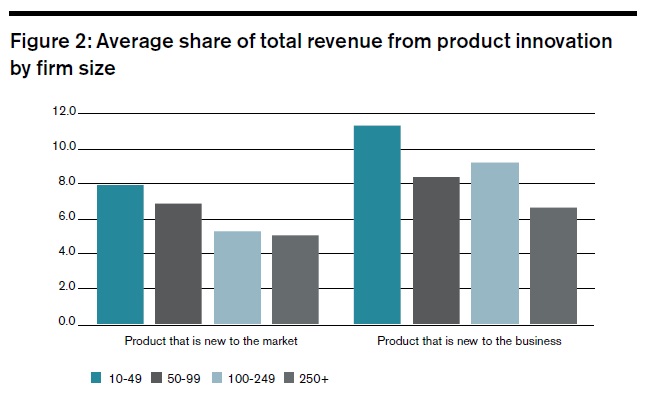

The latest results of the UK Innovation Survey suggests that small firms struggle to innovate, with just 13 percent investing in internal R&D compared with 23 percent of large firms. But there is evidence that small firms are more efficient at innovation, meaning they create more innovations for every unit of R&D expenditure as well as extract more financial value from these developments. Also, the very nature of innovation is changing. Investment in ‘intangible’ or ‘soft’ innovation – the generation of new concepts, designs and experiences – is estimated to have grown at twice the rate as spending on tangible innovation since 2000. This is important because micro businesses are arguably better placed to engage in the new kind with its lower resource requirements.

5. ... and job creation

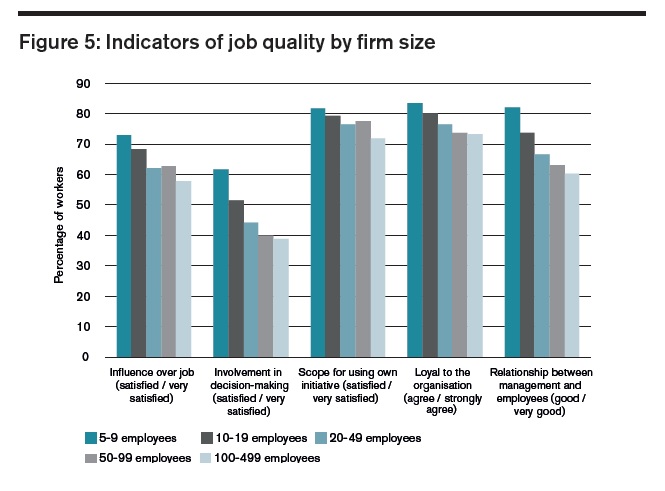

Employment opportunities within micro businesses appear bleak at first sight. Workers tend to be paid less, engage in training less frequently and have fewer benefits such as extended maternity leave. However, the latest results from the Workplace Employment Relations Study show that micro business employees are the most satisfied group of workers in the labour market, scoring highest on several indicators such as job control, influence in decision-making, loyalty to the business and even satisfaction with pay. Moreover, micro businesses are more likely to employ individuals on the economic margins, including migrants, the disabled and the recently unemployed.

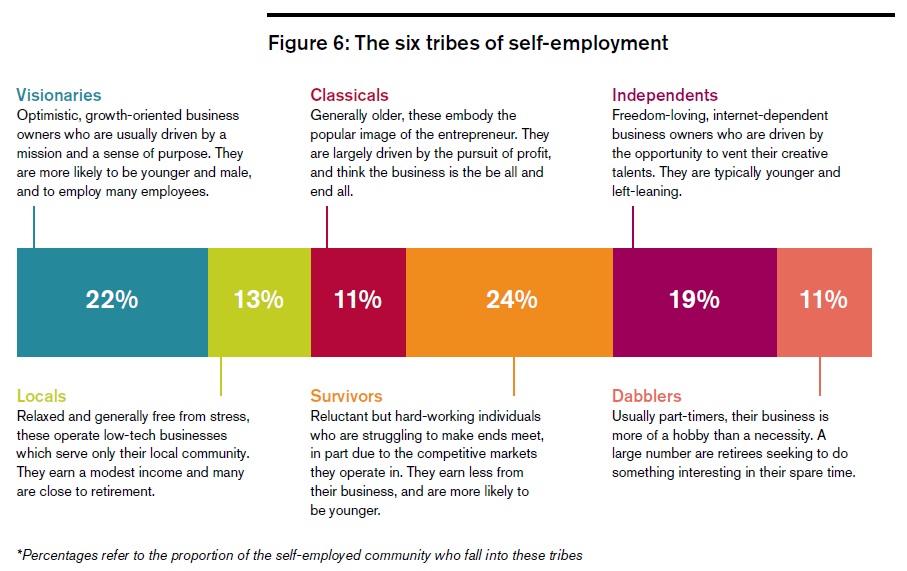

6. In any case, the value of micro businesses is not well captured by conventional measures

Whether looking at productivity, innovation or employment, micro businesses are clearly not the basket cases some argue them to be. But even still, we should question the extent to which conventional economic indicators capture their true value. Micro businesses bring colour and diversity to our economy, but this can hardly be articulated in facts and figures. Moreover, the people running micro businesses have different objectives, not all of which prioritise efficiency and innovation. Think of the hundreds of thousands of micro social enterprises that put purpose before excessive profit, or the many over 65s in self-employment who may have started a business for personal enjoyment rather than financial gain. Previous RSA research led to a segmentation of the self-employed that helps to articulate the different goals of this diverse community.

7. 5 key factors help to explain why micro businesses have become more economically viable

The clear message is that the rise of micro businesses is nothing to be feared. Rather, this trend should be taken as the sign of a prosperous nation transitioning into a different kind of economy. The question is why micro businesses are thriving today, and in particular within the UK. The most obvious reason is the emergence of new technologies, with the advent of the internet and the increasing sophistication of computing dramatically reducing the cost of doing business. Yet technology is just one among many drivers making micro businesses more viable. Rising skill levels, for example, mean that people have never been better equipped to work for themselves. Another driver is government policy, with successive governments since the 1980s pursuing a pro-business agenda of tax cuts and deregulation.

![]()

8. Rather than be preoccupied with micro businesses we should pay more attention to the activities of oligopolies

None of this is to say that large businesses are becoming irrelevant – far from it. Firms with more than 250 employees still account for half of all economic output in the UK. For the most part, very small and very big companies – mammoths and minnows – are able to live alongside one another for mutual advantage. However, in some sectors the balance of power has become skewed with the emergence of oligopolies (markets where a handful of firms dominate). According to one study, the top 5 companies own 89 percent of the market share in airlines, 70 percent in supermarkets, 80 percent in cinema screens and 91 percent in video games. While every industry is different, there is evidence to suggest that oligopolies can have a malign impact on consumers, small suppliers, innovation and the political process.

9. We can shape our economy – the status quo is not predetermined nor inevitable

To be clear, the problem does not lie with large firms per se, but rather the proportionate control that some have over their markets. The challenge for the government and others is to find the ideal level of concentration– that allows for both big and small businesses to flourish for the benefit of consumers, workers and entrepreneurs alike. While policymakers have in the past called for a rebalancing of the economy in terms of sectors, this report finishes by calling for a rebalancing in terms of market concentration. Indeed, it is important to recognise that the economy we live in is not predetermined nor inevitable, but rather a system that can be shaped if there is enough will to do so.

To correct this error:

- Ensure that you have a valid license file for the site configuration.

- Store the license file in the application directory.

Related articles

-

The self-employed: rich, poor or something more?

Benedict Dellot

Barely a week goes by without another news story charting the fall of self-employed earnings. But how much do the headlines match reality?

-

5 tax reforms to create a more entrepreneurial society

Benedict Dellot

Small businesses don't want sweeping tax cuts and special favours. They want a tax system that is clear, fair and progressive. Here are 5 ideas to get us started.

-

Blog: A Budget of boons for the self-employed

Benedict Dellot

Hidden away in the Budget Red Book were several announcements to satisfy the self-employed

Join the discussion

Comments

Please login to post a comment or reply

Don't have an account? Click here to register.

I run a micro property business developing historic buildings, set up to fill a gap I perceived in the 'system'.

Many people ( though not myself) set up small businesses as an alternative to being unemployed during the recession. Some were therefore bound to fail,but perseverance often wins, so second and even third attempts have proved successful based on experience gained.

My experience in the heritage was of enormous value and gave me confidence to go out on my own.

Productivity is bound to be high because a variety of skills will be utilised by one person e.g. building conservation skills,money management and public relations, all seamlessly intertwined. One is free to innovate.

Employment in a micro-business can be offered to other self-employed individuals , practices and organisations, adding to total economic growth, even where the contractor is a small unit itself.

Micro-businesses can afford to aim at longterm goals that are not available to big firms with a lengthy payroll. The freedom to think and act longterm is INVALUABLE.

Working for yourself is personally satisfying, varied and purposive , even if less remunerative than being a 'cog in a wheel.' One can be INSTANTLY flexible, imaginative and able to change direction ,or a previous decision, without fuss and bother or laborious consultation.

Hi Benedict,

This is a really interesting report.

On point 8.) What % of medium sized businesses started life as a micro business? My guess would be about 95%, the remaining 5% start life as well funded businesses, but they are the exception.

The more micro businesses that are started = the higher the number of successful SME's coming out the other side.

The most important factor in why Silicon Valley/SanFrancisco creates more global digital world beaters than any other city is simply because the density of start-ups (Micro businesses) per person of the local population is 10 times higher than New York or any other City in the US and probably more than 10 times higher than London.

Digital transformation and various efficiencies are allowing Micro businesses to compete head on with medium or large incumbents. I would propose that 75% of new innovation in consumer finance (as an example) are coming from Micro businesses.

Keep up the good work!

Ralph Hazell

Benedict,

An interesting report. Micro businesses are important to the economy and a few will become large businesses. It is often forgotten that all large businesses start as small businesses. eg Apple !!

I was trying to position myself in your "tribes" and since I have run my "micro" business for nearly 35 years (I employ 7 people), I guess I would be classified as "classical". The odd thing is, I have never been driven by profit alone, or see my business as the "be all and end all" as you describe. A very disparaging statement in my view. Although, it is of course essential for all businesses to make a profit.

Keith Gale

I just thought I would also mention the regulatory issue. I was at an IoD Seminar yesterday re the Digital Single Market. It was fairly clear from what I could see that even with the best will in the world regulators really struggle to balance the realities of small scale business with rules required to regulate larger scale entities. For instance - inter state VAT trading for digital services rules have evidently changed recently to try to stop some abuses (mainly from large companies manipulating their tax domicile to reduce VAT bills). VAT is now charged on the basis of the applicable rate at the point where the purchaser (not the seller) resides. Whislt improving the VAT take for a country like the UK this greatly complicates things for smaller on-line retailers. Possibly some sensible thinking around thresholds might have helped but no-one really argued for it at the time. Similarly the new Data Protection legislation - likely to be effective from early 2018 - is going to become a real handicap to small scale companies and start-ups as it requires complex and on-going consents re the use of personal data irrespective of the type of uses or attitudes of the individual.

Benedict

I've only had a chance to read your headlines so far, but wanted to raise the issue of the regulatory regime and how that skews the performance, growth and development of many micro businesses. The tax system, for example, from VAT through to personal allowances is geared up to create (and indeed sometimes frustrate!) the birth, growth and development of larger scale enterprises and this results in unintended barriers for micro businesses. This is evident in the VAT threshold, designed in the same era as the 70mph speed limit, neither of which recognise technological advancements which allow for greater control at higher operating speeds!

Another aspect worthy of more detailed consideration is the lack of any incentives in the market for connecting people and place, e.g. as the French do with their dual auditing arrangements which effectively pair up local accountancy firms with the large nationals, arguably providing a better service (whilst also securing the roots of the Republic!). Other aspects such as local taxation, or rather the lack of it, de-couple micro businesses from their communities, whereas BIDs tend to strengthen those connections enabling local scale businesses a measure of influence, even control over spend on their immediate operating environment, e.g. the attractiveness of the Town Centre.

Finally, I would welcome the opportunity to discuss any Scotland specific issues, particularly in the light of Smith and the Scotland Bill making a signal shift for the Scottish Parliament onto the income side of its balance sheet demanding amongst other things, a better understanding of these issues amongst policy makers and politicians.

Ross