Universal Credit was supposed to be the answer to a convoluted and bloated system of in-work benefits. The reality is a policy that will squeeze incentives to work and push many workers to the brink of poverty. Few have more to fear than the self-employed.

Universally panned

Universal Credit (UC) is back in the headlines – and for all the wrong reasons.

This week's PMQs were dominated by the revelation that it can cost up to 55p per minute to access the UC helpline – a figure that beggars belief. Last month, Citizens Advice issued a warning that UC is ‘a disaster waiting to happen’, pointing to many desperate claimants who are waiting 6 weeks to receive their first payment.

While these procedural challenges may be ironed out in time, the fundamental mechanics of UC are flawed. Analysis by the Resolution Foundation in 2016 showed that 1.3 million working families entitled to support through the legacy Tax Credit system will no longer be eligible for any in-work assistance, while a further 1.2 million will continue to receive support but be an average of £41 a week worse off.

As the researchers emphasise, UC won’t just push families into financial hardship; it will damage incentives to work as there will be little to gain in many cases from extending working hours. This is particularly true of second earners in couples and single parents.

The sinking of the self-employed

Yet of all the groups in the firing line, few have more to fear than the self-employed.

People who work for themselves will face a series of new draconian measures. Before being able to make a claim, they will first need to attend a Gateway Interview with a Jobcentre Plus work coach, who will determine whether or not they are ‘gainfully self-employed’ – that is, running a business with a reasonable expectation of profit. Those who pass this test will be exempt from having to search for other work.

Alongside this, the self-employed will have to start reporting their earnings on a monthly basis rather than annually, and do so through an online account.

However, unlike claimants looking for standard work as an employee, the self-employed will have their UC entitlement pegged to a Minimum Income Floor (MIF). This is an assumed level of earnings that, for most workers, will be the equivalent to the National Living Wage. Anyone earning below the MIF will not have the difference made up by a larger Universal Credit payment.

So, assuming the MIF is set at £1,100, a self-employed worker would receive the same UC entitlement whether they earn £300, £500 or £900 – a stark contrast to the Tax Credits system where benefits generally rise as earnings fall.

The rationale for the MIF is twofold: first to minimise the incentives for the underreporting of income; and second, to ensure the welfare system does not subsidise loss-making businesses indefinitely.

While these are sound principles, the design of Universal Credit jars with the reality of how businesses function. For example, the government has established a ‘start up period’ that will exempt the newly self-employed from the MIF during their first 12 months in business. Yet only a small proportion of the self-employed will be able to reach the equivalent of the National Living Wage in the space of a year.

Combined with the monthly reporting requirement, the MIF is also likely to be detrimental to claimants with a volatile income. Someone paid in large lump sums throughout the year may in one month earn so much that they are entitled to zero Universal Credit, while in another earn very little but see no increase in their UC entitlement due to the MIF. Think of farmers, actors, builders or virtually anyone doing seasonal work.

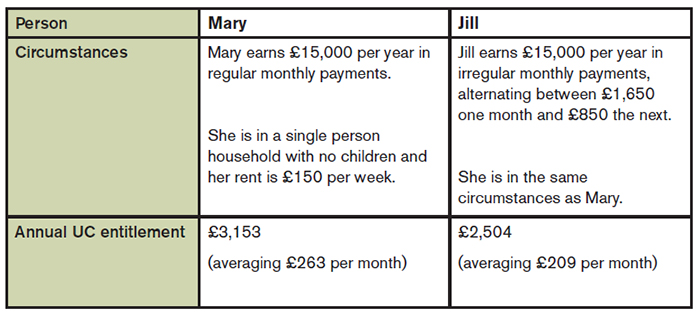

As the table below shows, two people can earn the same amount over the course of the year yet end up with very different UC payments because one has lumpier income patterns than the other. The MIF may also be triggered when claimants have a large expense in one month, such as an investment in tools or a hefty energy bill.

Other challenges relate to administration and compliance. A study undertaken by the University of York into the potential impact of UC found that many of the self-employed were comfortable with the idea of reporting their income on a monthly basis. Yet it remains to be seen whether claimants will always be able to meet the strict seven day reporting deadline.

Claimants may also have to provide a different set of information through the UC online portal to that required from HMRC for their Making Tax Digital updates and self-assessment forms, possibly necessitating two sets of books.

The road to redemption

Together, these problems will not only leave the self-employed materially worse off, they also risk sinking businesses that could in time be self-sufficient and net contributors to the exchequer.

The government could easily make amends. They could extend the start-up period from 12 months to 24 months, in recognition of the time it can take to get a business off the ground. They could shift the reporting period from a monthly to a quarterly basis, to help mollify the impact of lumpy incomes. And they could align the Universal Credit and tax accounting systems, reducing the toil of paperwork for claimants.

But will they? I suspect not, for the same reason that most attempts to protect in-work benefits fail: because we are talking about the poorest in society who have scant influence on politics and the machinations of Whitehall.

Just compare the muted concern over UC with the uproar that surrounded the planned rise in National Insurance contributions for the self-employed. Economic pundits, politicans and journalists lined up to denounce the Chancellors move, presumably because the affluent had the most to lose. So where are their voices now when we need to defend the low earning self-employed from the pernicious side-effects of welfare reforms?

It’s time all those interested in promoting self-employment woke up to the threat posed by Universal Credit and pushed for meaningful reform. Hundreds of thousands of livelihoods are at stake.

Join the discussion

Comments

Please login to post a comment or reply

Don't have an account? Click here to register.

Universal Credit, JSA and benefit sanctions and Child Benefit should be abolished forthwith. Regarding Universal Credit, there is only one thing that is universal about being a human being; we all have parents or we are parents. Therefore a Parenting Skills allowance should be paid to the parent and possibly the grandparent who has care and control of the children in the family and has passed a skills-test similar to a Childminders or Nursery Nurses or Foster parents qualification. This would automatically increase the supply of qualified childminders thus reducing the cost of childcare. Parents who choose to use a childminder would be better able to assess the suitability of a potential childminder for their children. I would set the allowance at 100 hours times NMW rate. Housing benefit would be payable after 20% of the household income for rent and 25% for mortgage repayments had been paid to make up any balance outstanding.

JSA would be replaced by a new kind of EMA; a Personal Development and Community Involvement Allowance set at 15 hours times the NMW. Claimants of this benefit would be required to do 5 x 3 hours of either/and/or Education or voluntary work e.g. amateur dramatics or athletics. It would be the claimant's choice. This would not cease if the claimant decided to do a six-week work trial with an employer. The employer could have two or more claimants on a work trial and would not have to pay wages during the trial unless the employer chose to do so. In this way, claimants could try out a job/career to see if it suited them. Employers would have to demonstrate how they are a "good" employer in relation to other employers. Claimants and employers could "test drive" each other to see which claimant or employer is best for them.

Regarding the Self Employed, they should be allowed to earn 100 hours times the Living Wage rate before tax is payable

Two things are necessary to bring about these changes; an alternative economic system and an alternative political party that can win a landslide victory to implement these changes.

Universal Credit is ridiculous as far as the self employed are concerned . It fails to acknowledge any difference between someone who has self employed earnings and someone who actually runs a business . If you have been self employed for more than 12 months the minimum income floor applies so It doesn't matter if you.ve earnt 100 300 or 900 your entitlement remains the same . If you have a family and are renting this is all disregarded and is taken away from all in your household including any children . Uc expects that any income from a business is your take home pay and doesn't allow for any losses or planning for future investment . So effectively your business is bankrupt once a month as anything earned is taken as personal income . It has finished the business I managed to get going for 2 years and has forced me into unemployment .

A rather interesting question is what actually is the income of a self-employed person?

Many, if not most, self-employed people have a business account for operating their business and transfer money from that to a personal account before they spend it for personal purposes. This transfer is referred to as a drawing from the business. For some purposes it's clear that a person's income comprises the drawings from the business - for example, that's the test used for determining income when applying for help with paying fees in the courts. It's not entirely clear what the position is for a person claiming Universal Credit - whether it is the month-to-month profit (and loss) of the business or the drawings from it that count as income.

There are also businesses where it would be atypical for there to be a steady income flow - farmers are a good example of this (some will have minimal or zero income for most if the year) but there are many others.

I also suspect we'll continue to see the sort of nonsense I have encountered in the past with the self-employed claiming benefits where basic errors such as using the gross income of the business, rather than profit, to calculate entitlement are not uncommon.