Long before Universal Basic Income (UBI) became caricatured by its opponents as a Silicon Valley conspiracy or an attempt to lay waste to working class communities through idleness and addiction, the RSA was looking at the idea as a means of helping to address prevalent economic insecurity.

For eighteen months prior to our first UBI report in 2015, we were interested in UBI as a potential contribution to and support for good work and wider well-being. The idea was that by providing a degree of security allied with freedom, people would be best placed to make better decisions about their own lives. UBI was never suggested as a panacea; rather it was proposed as a helping hand.

As the debate ignited over the past couple of years, as the idea moved from imagination to mainstream, even provoking a sense of regret in a US presidential candidate that the idea wasn’t embraced more readily, so the controversy and misinformation spread. Perhaps inevitably, too many advocates have over-claimed the benefits of UBI and the risks if it is not adopted. Too often, the argument has been preceded by scare stories of mass job-eating robots and UBI as a gateway to a post-work idyll. We accept neither of these overly gloomy or utopian visions.

But opponents have been all too willing to ignore the evidence of what UBI has been in practice – generally beneficial across the board in numerous trials – and too ready with reflexive caricature. For example, the latest economic research on Alaska, which has had a Basic Income style payment – albeit variable as a dividend – in place for over 35 years shows that unconditional, universal cash payments do not reduce employment at all whilst other research has shown they do increase well-being on a whole series of measures. The intensity of the interest wasn’t something we anticipated and it has been a double-edged sword. But time and time again we have returned to our original argument: a carefully implemented UBI would support good work – in the widest sense of the word – rather than usher in a post-work future.

Good and careful implementation is key. That is why we support trials, even when they are not pure ideal type UBI trials, in Finland and Canada. And the decision of the Scottish Government to scope trials is also to be strongly commended. The more understanding of UBI in practice we have, the better. So other trials in Stockton and Oakland in California are welcome too. We hope that, faced with mounting evidence of complete system failure in the UK benefits system, the UK Government will also support trials of alternative approaches involving UBI across the UK.

To secure public support, UBI will have to be developed carefully and in line with many prevailing norms. One of these norms is that people should make a positive contribution to society wherever they can. The argument to be had is with the notion that the hard conditionality of the current system is anything other than counter-productive in service of this expectation. We do not think any job will do and, indeed, that attitude has led to much harm alongside good with an economic price to pay through lack of appropriate skills matching and an absence of mobility for those who are most insecure. Far from an engine of mobility, conditionality creates human misery, insecurity, and locks people in sub-par work or poverty far too much. High employment is necessary but insufficient in combating economic insecurity. A stronger social contract is needed.

Our discussion paper published today is intended to widen the lens on UBI and economic insecurity rather than advocate an intractable position. We accept – as has always been our motivation – that UBI must be designed as a pro-good work institution. And we have always argued that UBI is part of a nexus of interventions including support for lifelong learning, support into work, caring (including childcare), support for workers from unions and professional associations, a genuine commitment to good work and investment in people from more employers, and the right legal framework underpinning good work.

At the core of today’s paper is an idea that we hope anyone interested in the future of work and well-being will engage with. In order to help provide greater security as people need to navigate economic, technological and care challenges in the 2020s, the idea is to provide up to two years of a £5,000 payment for each family member. This will enable people to re-train, try a new business idea, assume caring responsibilities, and perhaps try a new career. It gives people a helping hand to adapt to change; something we don’t believe the current social contract does adequately.

Our primary concern is economic insecurity. In Addressing Economic Security, Atif Shafique offered a new way to think about insecurity: defining it as both an economic and psychological state influenced by a range of interrelated factors beyond merely employment status. This approach questions a notion that has underpinned public policy for quarter of a century, namely that there is a cast-iron equation between having a job and economic security. And Brhmie Balaram and Fabian Wallace-Stephens, in Thriving, Striving, or Just About Surviving?, showed that 30 percent of workers face chronic or acute precariousness with a further 40 percent facing uncertain futures. Access to £5,000 per annum per family member for two years could be just the support that makes a risk manageable or an opportunity worth taking. Think of it as a student grant for basic rate taxpayers and their families.

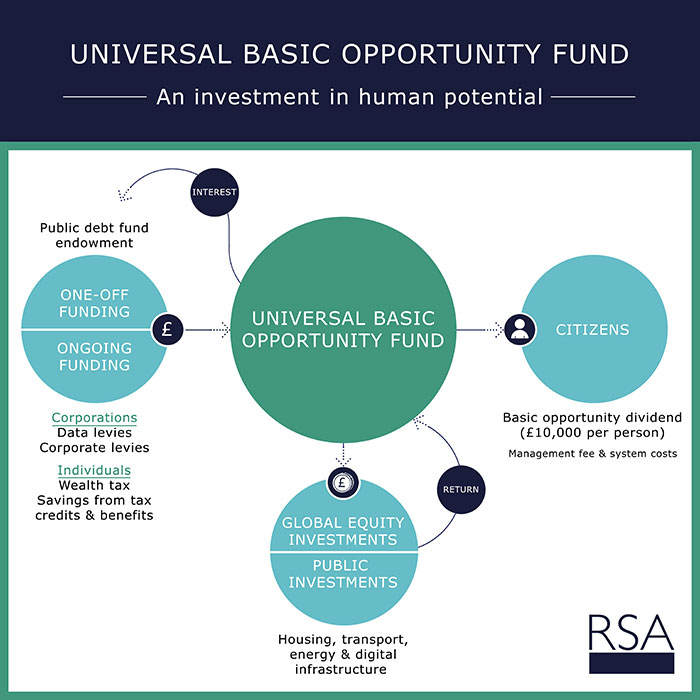

To fund the ‘Universal Basic Opportunity Fund’ (UBOF), the Government would finance an endowment to cover the fund for 14 years from a public debt issue (at current low interest rates). This endowment would be invested to both fund asset growth and public benefit. The fund could be invested in housing, transport, energy and digital infrastructure and invested for high growth in global assets such as equity and real estate. This seems radical but actually, similar mechanisms have been established in Norway, Singapore and Alaska. In the latter case, Basic Income style dividends are paid to all Alaskans. Essentially, the UBOF is a low-interest mortgage to invest in infrastructure and human growth that brings forward the benefits of a sovereign wealth fund to the present rather than waiting for it to accumulate over time.

These investments would provide returns to support the £5,000 payments to citizens and could be supported by a range of redistributive mechanisms such as corporate levies, high net wealth taxes, equity transfers from leading companies, and we have even suggested exploring a charge on UK data assets that are transferred to global platforms. The maximum cost of the Basic Opportunity Dividend as we have modelled it is £14billion per year. By way of comparison, corporate tax reductions since 2010 are expected to cost the Exchequer £16billion per year by 2020. And the fund will both support physical infrastructure and, if they match the return achieved by Norway’s sovereign wealth fund, would cover half of the cost of the Basic Opportunity Dividend. The following illustrates how this works:

The advantages of this approach are that it is redistributive, it is something that could be done now, it doesn’t lean heavily on income tax, and provides a framing for UBI that is definitively pro-opportunity, pro-contribution and pro-good work. And it’s a large scale Basic Income experiment before full adoption. The economic impacts – and there could be a significant uplift in productivity as people invest in their futures and find the best use for their skills – and social consequences, positive or negative, can be tracked including during an initial four year period when the fund would be available to 25 per cent of the population.

The design principles and funding mechanisms we lay out could allow citizens to make major changes to their lives which they would otherwise be constrained from doing. A low-skilled worker might reduce their working hours to attain skills enabling career progression. The fund could provide the impetus to turn an entrepreneurial idea into a reality. It could be the support that enables a carer to be there for a loved one without the need to account for one’s caring to the state.

UBOF could be the first step towards a new model of social security which puts faith in people to make decisions pertaining to the aspirations that they have for their lives. It represents an investment in human potential; measured not just in GDP or productivity growth but in security, opportunity, creativity, fulfilment and wellbeing also. As a practical means of advancing the UK towards a Universal Basic Income system, the UBOF could represent a stepping stone – to be enacted now – towards a better way of enabling citizens to live meaningful and contributory lives.

Join the discussion

Comments

Please login to post a comment or reply

Don't have an account? Click here to register.

As per our discussion on Twitter with Jamie, I fully support the concept of UBI but I'm very disappointed to see the RSA exclude those of us who are over 55. I have only been a member of the RSA for 3 years but have made as much effort as I can to support its work whenever possible, as I believe do many other FRSAs who are 55+. Why are we excluded from this scheme? Is the RSA so out of touch that it doesn't realise how many people in the 55-65 group are struggling, especially many former management/execs who lost employment in 2008 never to find full time employment again? Who are deeply concerned not just for themselves, but for the general shift in longevity which means whatever they have acrued might have to 'last' another 30 years? UBI must be fully inclusive, or it's not Universal, is it?

Oh i couldn't agree more . Having taken on the care responsibilities of my mother at the age of 65 , I now have no job - as trying to work and be a carer was proving almost impossible, and adding to my stress. I am not in a position to claim a carers allowance, but I have no real income . I am writing which is good for my sanity and who knows maybe my bank balance, but I have no real future security. There must be so many people of my age group and especially women who were not encouraged to have careers, who stayed at home to bring up the family, as was the norm when I had children, and now consequently have no pension funds or savings to fall back on. To be omitted from the concept of UBI - which I fully support as a concept - just adds to the feeling of worthlessness and isolation that is ever present. Universal must mean universal, otherwise it places a whole sector of the population into the hinterlands which is surely the absolute opposite of the intention of UBI.

Hi, Our proposal for full basic income includes all those of basic state pension age (all of whom would receive it which isn't the case currently as the pension is based on previous contributions). One of the stepping stones to UBI is making the basic state pension fully universal (and it is significantly higher than most working age Basic Incomes that have been proposed). This proposal is deliberately focused on those of working age as too many don't have access to resources to change track/try new things (those of Basic State Pension age either have a state pension or pension credit currently). But a full UBI would include all.

thank you for that clarity and what a difference that would make to so many lives. it would also i believe be economically sound and reduce many of societies problems that cost so much to put right.

I would say until death! surely?

Hi Jenny, thank you for your comment. I have put some thoughts on these issues in a blog reflecting on the (very lively!) public discussion that our idea provoked.

<a href="https://www.thersa.org/discover/publications-and-articles/rsa-blogs/2018/02/the-response-to-the-universal-basic-opportunity-fund">The response to the Universal Basic Opportunity Fund</a>